Randy Engel

Introduction

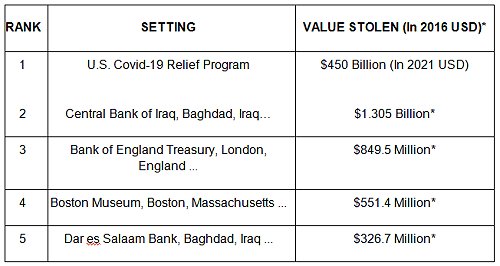

As of the late fall of 2021, the American taxpayer has been swindled out of a minimum of $450,000,000,000 of “pandemic” relief funds from the U.S. Government’s Covid-19 Economic Relief Program by organized criminal networks worldwide. According to reporter Stephen Moore of the Boston Herald, the above figure includes $150 billion in theft from the Federal Pandemic Unemployment Compensation (FPUC); an estimated $200 billion in wrongful payments under Medicaid; and at least $100 billion of fraud in the Small Business Paycheck Protection Program.[1]

Although the Biden Administration has recently appointed Associate Deputy Attorney General of the Justice Department, Kevin Chambers, to lead the government’s investigation of the biggest theft ever recorded in the history of mankind, it’s unlikely that most of the stolen funds will ever be recovered. Americans can kiss their hundreds of billions of tax dollars goodbye.

Where Did the Other Multi-Trillion Dollars Go?

The problem with the above scenario, outrageous as it is, is that it prevents Americans from asking a more important and timely question, “Where did the other three trillion dollars and some billion dollars in change go between March 2021 and January 2022? Considering the fact that the entire federal budget for FY 2021 was $6.8 trillion and the Internal Revenue Service only took in $3.863 trillion in taxes in 2021, this is a question that every American should be asking their Congressman and Senators. This out-of-the world highway robbery gives a totally new spin (as if we need more spinning) to the Covid-19 scamdemic and who profits from it.

But not to worry. USAspending.gov is here to help Americans answer that question!

But not to worry. USAspending.gov is here to help Americans answer that question!

Thanks to this online government program, American taxpayers can (at least partially) trace the already spent Covid-19 campaign total outlays of $3.6 trillion taken from the $4.6 trillion in total budgetary resources.

The Federal Funding Accountability and Transparency Act of 2006 (FFATA) was signed into law on September 26, 2006. The legislation required that federal contract, grant, loan, and other financial assistance awards of more than $25,000 be displayed on a publicly accessible and searchable website to give the American public access to information on how their tax dollars are being spent.

COVID Relief Spending | USAspending[2] is a website of the U.S. government. Its total, overall financial data is uploaded directly from more than a hundred federal agencies' financial systems and some three hundred other government systems – four hundred data points in all. All the data and information in this section have been taken directly off the Covid 19-USAspending website.

Presidential Spending for Covid-19 Relief Programs

The CARES Act (Coronavirus Aid, Relief, and Economic Security) is a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by Republican President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 “pandemic” in the United States. The Cares Act provided American families with directly received stimulus checks of up to $1,200 per eligible adult and $500 per eligible dependent child. In December 2020 following the presidential elections, a second round of stimulus checks were authorized by President Trump providing up to $600 per eligible adult and dependent child.

In addition to the issuing of stimulus packages which added up to $300 billion, the Trump-approved CARES Act provided $260 billion in increased unemployment benefits, $350 billion for the creation and operation of the Paycheck Protection Program that provides forgivable loans to small businesses, $500 billion in loans for corporations, and $339.8 billion to state and local governments.

Also, under the Trump Administration, Operation Warp Speed was initiated as a joint government and private venture aimed at the research, development, and pre-approval manufacturing of Covid-19 “vaccines” (a misnomer) at a cost of $12.4 billion.

On March 10, 2021, under the Democratic Biden Administration, Congress approved an additional $1.9 trillion package deal under the American Rescue Plan Act., which, like the Trump program was to speed up the United States' recovery from the economic and health effects of the COVID-19 “pandemic” and the ongoing recession.

On March 11, 2021, exactly one year to the day after the World Health Organization declared COVID-19 a global “pandemic,” President Biden signed the $1.9 trillion American Rescue Plan Act into law. It provided a third round of stimulus checks of up to $1,400 per American adult and dependent child. Like the Trump program, Biden’s ARPA was ostensibly intended to speed up the United States' recovery from the economic and health effects of COVID-19 and the ongoing recession.

Together, the Trump and Biden Administrations approved a minimum of $4,100,000,000,000 in Covid-19 relief funding, of which $3.21 trillion has already been spent and is not retrievable.

This article is about where these trillions of U.S. tax dollars went. But before getting into specifics, here are some basic information and glossary on government spending of your tax dollars during the alleged “pandemic.”

Three Categories of Covid-19 Relief Funding

Pandemic funding on COVID Relief Spending | USAspending is broken down into three categories:

- Agencies – The term agency refers to any federal department, commission, or other U.S. government entity including sub-agencies.

- Federal Accounts – Federal Accounts refer to the set of Treasury spending accounts that are grouped under a given "Federal Account Symbol." These are grouped by their agency identifier (3-digit code) and Main Account code (4-digit code).

- Object Classes – Object class is one way to classify financial data in the federal budget. An object class groups obligations by the types of items or services purchased by the federal government.

Federal Agencies Involved in the Scamdemic

There are a total of forty-four federal agencies directly involved in the Covid-19 relief program.

The following is the outlays of tax dollars spent by the top twenty of the federal agencies during the Covid-19 “pandemic”:

Departments of the Treasury ($1.388 trillion), Small Business Administration ($937 billion), Labor ($672 billion), Health and Human Services ($257 billion), Education ($114 billion), Agriculture ($97 billion), Transportation ($50 billion), Homeland Security ($26 billion), Veterans Affairs ($18 billion), Housing and Urban Development ($6 billion), Defense ($7 billion), Commerce ($1 billion), State ($2 billion), Interior ($2 billion), Justice ($1 billion), Federal Communications Commission ($2 billion), Agency for International Development ($ 2 billion), General Services Administration ($131 million), the Social Security Administration ($ 353 million), and the Corps of Engineers-Civil Works ($52 million)

Lesser grants were given to the National Science Foundation ($95 million), National Endowment for the Arts ($86 million), Peace Corps ($131 million), John F. Kennedy Center for the Performing Arts ($17 million), and the Institute of American Indian, Alaska Native Culture and Arts Development ($78 thousand), Institute of Museum and Library Services ($92 million) and eighteen other federal agencies.

The Second Layer of Covid-19 Grants, Loans, etc.

After these federal agencies have received their funding, the Covid-19 relief monies begins to flow outwards on a secondary level to individuals, organizations, businesses, and state, local, or tribal governments that the federal government has determined worthy of awards in the form of grants, loans, direct payments, and other forms of financial assistance. At this point , the money is obligated (promised) and then outlaid (paid) according to the terms of the contract or financial assistance.

According to COVID Relief Spending | USAspending:

The Number of Awards for all federal Covid-19 relief programs is listed as 21.78 million or 21,780,000.

The number of Recipients is listed as 14.81 million entities, that is, 14,810,000 individuals, businesses, states, etc.

The Award Obligations for all awards is $2.32 trillion or $2,320,000,000,000.

The Award Outlays for all awards is $1.90 trillion or $1,900,000,000,000. That’s tax money already spent, not just promised to be paid ("obligated").

When awarding funding, the U.S. government enters a binding agreement called an obligation. The government promises to spend the money, either immediately or in the future. An agency incurs an obligation, for example, when it places an order, signs a contract, awards a grant, purchases a service, or takes other actions that require it to make a payment.

Amount of Funding States Received from Uncle Sam

The COVID Relief Spending | USAspending website provides a map showing the amount of funding each state has already received. Needless to say, urban port states raked in most of the billions spent on Covid-19 Relief aid.

For example, New York State received $161.1 billion, while California took in $268.3 billion in awards funding. Inland rural states received minimum funding, for example, Wyoming received $5.1 billion, Kansas $16.3 billion and South Dakoda $8.3 billion in financial relief aid. My state of Pennsylvania received $78.1 billion for 630,042 awards. What did your state receive?

The USAspending map is done on shades of blue and black, but, just for fun, I would have loved to have seen a separate map with the same figures but in shades of red for the Republican Party and blue for the Democratic Party.

Major Categories of Recipients of COVID-19 Relief Program

This writer spent more than 9 days going over the federal outlays of Covid-19 relief funding from March 2020 to January 2022. Obviously, any reviewing of all the federal government’s awards numbering in the millions is outside my purview, and that of most reporters I know. Also, the available data on the website only indicates the amount of the loan, grant, or contract and the name of the recipient, but not HOW the money was spent once received making real time accountability impossible.

Nevertheless, I consider the time was well spent in that it gave me some insights into the specific broad categories of the Covid-19 relief recipients and a general overview the tax monies were used.

Grants – 26,000 in number awarded to the following entities (partial listing):

- States, Governor’s Offices, Departments (Education, Health, and Human Services, etc.)

- Native American Tribal Governments and Nations (*Grants in the billions of dollars)

- Physician and Health Care Services

- Public School Systems and School Boards of Education

- Government Departments of Family Services

- Airlines (American, Delta, United, Southwest, etc. – individual grants ranged from $12 billion to $ 700 million). Some airlines received multiple grants.

- Transit Services

- Government Departments of Social Services

- Housing and Community Affairs Agencies

- Drug Stores and Pharmacies (Walgreen Co. $1 billion, Rite Aid $507 million)

- State and Private Universities and Colleges (examples: Duke University/$63 million, Baylor University/$182 million, Rutgers State University/$215 million, Liberty University/$52 million, Cornell University/$36 million, St. John’s University, N.Y./$60 million)

- AIDS Services

- Government Departments of Child Services

- Environmental Agencies

- Guam, U.S. Virgin Islands, Puerto Rico, American Samoa

- United Nations ($637 million)

- Bio-Medical Research Centers

- Pharmaceutical Companies

- World Health Organization ($280 million, $773 million)

- Medical Corporations

- Family Health International ($139 million)

- Technology Companies – General Dynamics Information Technology ($62 million)

- Consulting Firms

- Government Departments of Aging and Disabilities

- Public Safety Agencies

- Government Departments of Labor and Employment

- Catering Services for Airlines aka Gate Gourmet

- Mental Health and Substance Abuse Services

- Government Departments of Military Affairs

- Emergency Management Agencies

- nternational Organization for Migration ($50 million)

- Board of Trustees and Regents at Various Universities

- International Federation of Red Cross and Red Crescent Societies ($26 million)

- Pontifical Catholic University of Puerto Rico ($45 million)

- Save the Children Federation ($38 million)

- Task Force for Global Health ($21 million)

- Pan American Health Organization ($12 million)

Loans: Number in excess of eleven million. There is no designation as to loans which do or do not have to be repaid:

- First United Methodist Church ($32 million)

- First Baptist Church ($17 million)

- Catholic Bishop of Chicago * Cardinal Blase Joseph Cupich ($15,435, 082)

- YMCA ($17 million)

- Trinity Lutheran Church ($14 million)

- First Presbyterian Church ($14 million)

- Union of Orthodox Jewish Congregations ($10 million)

- Goodwill Industries ($11 million and multi-local loans in the $10 million range

- Muscular Dystrophy Association ($10 million)

- Salvation Army ($10 million)

- Screen Actors Guild-American Federation of Television and Radio Artists ($10 million)

- Planned Parenthood of Greater New York ($10 million)

- March of Dimes ($10 million)

- Los Angeles Lesbian, Gay, Bisexual, and Transgender Center ($10 million)

- Star Tribune Media- Minneapolis, MN ($10 million)

- Local Medical Clinics (in the $10 million range)

Thousands of non-profits, restaurants, small businesses, and large corporations are listed in the loan category. The above is just a sampling.

Direct Payments: Number in the five million mainly to State and City Governments. Most are in the billion dollar range including:

- State Governments and Executive Offices

- Airlines – American Airlines ($9 billion), Delta ($8 billion)

- United Healthcare Services ($154 billion in direct payments and other contract funding)

- Native American Tribal Governments and Nations (*Direct payments in the billions of dollars)

Other Financial Assistance – Including the:

- World Health Organization ($279 million)

- UNICEF ($204 million)

- United Nations ($20 million)

- Native America Tribal Governments and Nations (*Hundreds of grants in the billions of dollars)

Contracts: 15,000 plus in number mainly to hospitals, medical centers, institutes and corporations, pharmaceutical firms. health services, think-tanks, schools of medicine, food conglomerates, systems corporations, consulting firms, university medical schools, supply firms, and “vaccine” manufactures. These include contracts to the –

- America’s Blood Centers ($523 million)

- Life Technologies Corporation ($140 million)

- Merck Corporation ($17million)

- Pfizer ($37 million)

- Mayo Clinic ($51 million)

- Rand Corporation ($5 million)

- Medline Industries ($9 million)

- Boeing Company (Multiple outlays of Covid-19 funding including a $105 million contract)

- Johns Hopkins University($5 million)

- St. Jude Children’s Research Hospital ($4 million)

- Native American Tribal Governments and Nations (*Additional contracts in the millions of dollars)

Catalog of Federal Domestic Assistance (CFDA) Award Spending (Assistance Listing)

According to COVID Relief Spending | USAspending, the overall financial assistance awards represent the vast majority of COVID-19 appropriated spending. The CFDA Programs provide financial assistance to individuals, organizations, businesses, or state, local, or tribal governments. All financial assistance awards must be associated with a CFDA Program and be explicitly authorized by law. The number of CFDA Programs listed in this section is 426. The number of awards (many in large block grants) is 21.72 million at a financial outlay of $1.87 trillion. Award funding includes funding to/for:

- Block Grants for Child Care and Development ($13 billion)

- Community and Migrant Health Centers, Health Care for Homeless, etc. ($3 billion)

- National School Lunch program ($7 billion)

- Block grants for Community Mental Health Services and Substance Abuse ($232 million)

- Public and Indian Housing ($683 million)

- Special Educational Grants for Infants and Families ($1 million)

- mmunization Cooperative Agreements ($1 billion)

- Head Start ($822 million)

- Indian Community Development Block Grants ($206 million)

- National Bioterrorism Hospital Preparedness Program ($383 million)

- Endangered Species Recovery Implementation ($100 thousand)

- Telehealth Programs ($15 million)

- Aging Research ($9 million)

- Polar Programs ($249 thousand)

- Food and Drug Administrative Research ($1 million)

- Family Planning Services ($533 thousand)

- Nurse Education, Practice Quality and Retention Grants ($3 million)

- Cancer Cause and Prevention Research ($ 1 million)

- Indian Law Enforcement ($1 million)

- Promotion of the Arts Agreements ($45 million)

Clearly the mind-boggling amount of tax dollars and numbers of federal agencies and millions of awards and recipients involved, accounts for the government’s unlimited ability to propagandize and saturate every segment of American society with the ongoing “official” Covid-19 narrative of the hour, day, week, month, and year.

This partial and minute examination of the federal government’s multi-trillion dollar Covid-19 misadventure incited by BOTH the Republican and Democratic Parties, at the American taxpayer’s (aka modern “serfs”) expense should raise a thousand and one questions and observations in the reader’s mind.

Here are some of my questions and observation.

Who Profited Most From the Covid-19 “Rescue” Plan?

Well, apart from the worldwide criminal network who stole a minimum of $450 billion tax dollars as reported by the Labor Department and the Small Business Administration to the Secret Service and Justice Department, I’d have to say, first, the federal government’s already bloated administrative bureaucracies of the 44 agencies directly involved in the Covid-19 “Rescue” Plan and the 50 states, the federal district of Washington, D.C., American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, the U.S. Virgin Islands, nine minor outlying islands, and 326 Indian reservations.

American Indian Recipients

Speaking of Indian reservations, one of the rather surprising observations I gleaned from viewing several thousand listings of grants, loans, etc. awarded under the Cares Act and the American Rescue Plan Act was the that the American Indian, of all the ethnic groups in the U.S., was the greatest beneficiary of government largess.

For example, the Cherokee Nation received $3.2 billion in grants; Navajo Tribal Government $3 billion; Choctaw Nation $1 billion; Chickasaw Nation ($1 billion); and the Creek Nation $1.billion, and so on, down the line.

Unfortunately, these billions come at a high price, as the American Indian is among the federal government’s most targeted ethnic group when it comes to getting the Covid-19 “vaccine” and multiple boosters.

How do I know this? Easy. I tune into the Health Affairs Forefront (HAF) on a regular basis.

In the words of HAF editor-in-Chief Alan Weil (he’s not a real Indian), “[This] is the place where government officials announce new initiatives, policy ideas are vetted, and thought leaders provide up-to-date and curated analysis on the leading edge of health policy.” So the blog is not some fly-by-night affair.

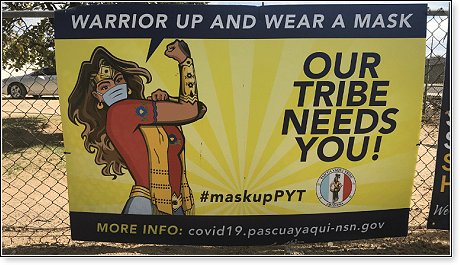

On July 29, 2021, Health Affairs Forefront carried an article titled “Native Americans And Covid-19 Vaccine Hesitancy: Pathways Toward Increasing Vaccination Rates for Native Communities,”[3] by Gabriel R. Sanchez and Raymond Foxworth.

Above the opening text (with supporting references) is picture of a banner featuring a well-endowed, masked Indian version of Wonder Woman along with the slogan “Warrior Up and Wear a Mask.” I found it a bit sexist, but then, who am I to judge.

The authors state that Native American communities have disproportionate rates of Covid-19 infection, hospitalization, and causality due to longstanding “inequalities,” “federal neglect and marginalization,” and other factors such as lack of water and access to adequate public health information. The response of the native population, they report, has been to get vaccinated in record numbers, the rate being higher than other racial and ethnic groups. A third (32% ) of Native Americans have received at least one dose of a Covid-19 vaccine, compared to 19% of non-Hispanic White Americans.

So “Where’s the beef?”

The non-vaccinated American Indian, of course.

It appears that a large segment of the Native Indian population has not gotten the jab, but what is worse, is that many don’t WANT to get the jab – ever. Some tribal leaders have even expressed concern about the safety of the Covid-19 “vaccine,” which as we know, is really not a vaccine at all in the traditional sense, but an experimental form of gene “therapy” that can and does kill.[4]

According to the authors, a national survey funded by the (anti-life) Robert Wood Johnson and W.K. Kellogg Foundations and designed by public health experts from the University of California (L.A.), Yale, Penn State, University of Mexico, and the University of Maryland (all of these institutions are Covid-19 Relief grantees) demonstrates the necessity of overcoming “vaccine hesitancy” among the Native American Indian population “by culturally-significant” government propaganda that emphasizes the protection of “the lives of my family. friends, and those I love.” The article ends with a plea to “motivate the unvaccinated population communities “to get their shot … .”

The Non-Profit Boondoggle

Under the CARES Act and the American Rescue Plan Act, non-profits including churches and welfare and “health care” agencies have received hundreds of millions of tax dollars. In many cases the designated category of “health care” is misleading, deliberately so.

For example As highlighted above in red, Planned Parenthood of Greater New York (aka Murder, Inc.) received $10 million in a single loan. I did not go far enough into the loan category to establish if other city and state Planned Parenthood butcher shops, six hundred of them, and the national offices in New York City and Washington, D.C., received other loans and/or grants, or whether or not the federal outlays were repayable. What we do know is that the $10 million loan is but a small portion of the $618.1 million that Planned Parenthood took in nationally in taxpayer grants for the fiscal years (2018-2019).

Still it’s not chicken feed. During the Covid-19 Relief loan period Planned Parenthood of Greater New York celebrated the completion of two expansion and modernization projects at PPGNY “health centers” in the Bronx and Brooklyn.[5] And the PPGNY’s Chief Executive Officer and Chief Medical Director managed to each take home annual salaries in the six figures.

The reader also will recall the Covid-19 “Family Planning” grant of $553,000 grant listed above to establish population control programs for low income families in Washington, D.C., Puerto Rico, the US Virgin Islands, and the six pacific jurisdictions.

The March of Dimes

Then there is the anti-life March of Dimes, the nation’s number one promoter of eugenic abortion. It also drew $10 million in a single Covid-19 Rescue loan. The MOD may be technically a “non-profit,” but its annual receipts are over $100 million (2020), and its President and CEO’s annual salary and benefits is over a half-million bucks.[6]

Perversions, Incorporated

Also, let’s not for forget the alphabet soup LALGBTI (Los Angeles Lesbian, Gay, Bisexual, and Transgender [and Intersex] Center that also received a Covid-19 Relief loan in the $10 million range. The Center promotes itself as one of the nation's largest and most experienced health and mental healthcare providers, serving the lesbian, gay, bisexual, and transgender (LGBTI) community, and has been working arduously – for more than 48 years – to continue advocating for the rights of LGBTI people.[7] The LALGBT Center feeds mainly at the taxpayer’s trough to the tune of over $154 million annually. Why did it qualify for a Covid-19 $10 million loan?

Save the Children Foundation, Inc.

The Save the Children Foundation, Inc., another multi-million non-profit entity ($869 million in 2020) received a Covid-19 Relief grant of $38 million. The foundation which operates in the United State and around the world in Africa, Asia, and the Middle East, is of particular interest because of its promotion of the dangerous Covid-19 vaccines for children, including children under six, which the foundation unabashedly advocates. The foundation’s theme, “We Need Vaccines for All – Not For the Few.”

According to the Foundation website, “The emergence of safe and effective COVID-19 vaccines offers hope, but we can only end this pandemic through fair and equal access to vaccines for all. Since the earliest days of the pandemic, Save the Children has been one the front lines. With the help of our supporters, so far, we've reached 29.5 million people impacted by COVID-19, including 11.8 million children.”[8] The dangers to children and young people from the vaccine are either ignored or minimized on the foundation’s website and its recommended sites.[9]

Churches and Synagogues

As for loans made to main line Catholic dioceses, Protestant churches and Jewish synagogues including the $15 million dollar grant to the Archdiocese of Chicago, I believe these were a prime factor in the almost total capitulation of religious groups to the closing of houses of worship early in the Covid-19 scamdemic.

Cardinal Blase Joseph Cupich inflicted some of the severest restrictions of the federal government on his flock, and required all diocesan employees and clergy to get the Covid-19 “vaccine” with no exemptions for religious reasons, only medical reasons.

Was government funding an incentive to American religious leaders to follow the government narratives on the Covid-19 Relief program even when they were misleading or downright untruthful? You think?

Mass Media Bribes

It is now known that the federal government made secret direct payments and loans to nearly all major corporate media outlets at a cost of $1 billion to the taxpayer. In return these media outlets pushed only the government narrative that the Covid-19 vaccine was “safe and effective,” while censoring any negative narratives on the dangers and ineffectiveness of the vaccine.

For example, Star Tribune Media of Minneapolis, MN received $10 million in Covid-19 Relief funds The media outlet is owned by American billionaire businessman Glenn Taylor.

The other hundreds of federal bribery grants were buried too deep in the data for me to cite here.

Physician Bribes

We also know today that physicians in the United States have received financial “incentives” from the federal government if they are willing to give the Covid-19 “vaccine” and booster shots. Forty-dollars is given to a compliant physician for every Covid-19 jab and booster he administers.[10] This means $120 for every patient received three injections. U.S. primary care physicians have from 1,200 to 2,500 regular patients. Using the average of about 1,800 patients, American doctors made about $216,000 each in extra income last year if they managed to motivate their patients to receiving three shots. The funding for these bribes is hidden somewhere in the Department of Health and Human Services’ Covid-19 Relief awards outlay of $257 billion.

For the record, this writer never saw a single loan or grant for a pro-life anti-abortion non-profit organization listed on the COVID Relief Spending | USAspending after nine days of research. If such a grant, loan, or contract exists, I would appreciate being informed of the fact.

In Conclusion

Are there lessons to be learned from reading this article?

Yes, many lessons I would say, the most obvious being that money talks, walks and buys SILENCE even in matters of life and death.

Whether the entity receiving Covid-19 Relief payoffs is a federal, state, or local government agency or department, a non-profit, a university or college, a business, a corporation, a foundation, a medical research center, a hospital or other health care facility, a pharmaceutical house, a school, an Indian nation, a museum, a church – you name it – chances are that it is backing or at least excusing the whole Covid-19 scamdemic including the trillion dollar Covid-19 Relief Program passed by both Democrats and Republicans.

It doesn’t seem to matter how much the National Institute of Health, the Food and Drug Administration and the Center for Disease Control, all with conflicts of interest up the old wazoo, and the Pharmaceutical firms involved in the manufacture of a Covid-19 “vaccine,” outright lie to the American people and deliberately manipulate Covid-19 data to fit the narrative of the day, however dangerous and insane that narrative is.

Only a small handful of Congressman and Senators seemed to get excited when the U.S. Secret Service announced the greatest theft of government taxes in the history of the world last fall.

Why hasn’t there been an open Congressional hearing on the entire Covid-19 debacle orchestrated by the federal government with the backing of the unseen hand of the elites of the New World Order?

Am I the first writer you know of in the U.S. who has attempted to explain how the trillion dollars in Covid-19 Relief Funds was spent? If so, how do you explain that?

It’s time for Americans to try and think through the Covid-19 “pandemic” or “scamdemic” – however you choose to define it – and demand a full accounting from the U.S. Congress on every aspect of the Covid-19 campaign which it voted to fund with our tax dollars.

Nothing less will do.

If Americans don’t get to the truth concerning this greatest government misadventure of all times, we will most certainly get what we deserve – another replay of the same. Count on it.

________________________[1] Stephen Moore, “Moore: The state of the union is in the poorhouse,” Boston Herald, March 4, 2022.

[2] See COVID Relief Spending | USAspending.

[3] See Native Americans And COVID-19 Vaccine Hesitancy: Pathways Toward Increasing Vaccination Rates For Native Communities | Health Affairs .

[4] See Planned Parenthood’s New Report Reveals More Than 8.6 Million Abortions (townhall.com).

[5] See Planned Parenthood of Greater New York Announces Expansion and Modernization of its Bronx and Brooklyn Health Centers | Planned Parenthood of Greater New York.

[6] See GuideStar for March of Dimes 2020 IRS return at

[7] See Volunteer – Los Angeles LGBT Center (lalgbtcenter.org) and LALGBTC21_AtAGlance_2021_FINAL2.pdf (lalgbtcenter.org).

[8] See We Need Vaccines for All – Not For the Few | Save the Children.

[9] See Information for Kids About Covid Vaccine – Bing video.

[10] See Medicare COVID-19 Vaccine Shot Payment | CMS.

© Randy EngelThe views expressed by RenewAmerica columnists are their own and do not necessarily reflect the position of RenewAmerica or its affiliates.